1.0 This information meets the requirements of the Consumer Protection Act.

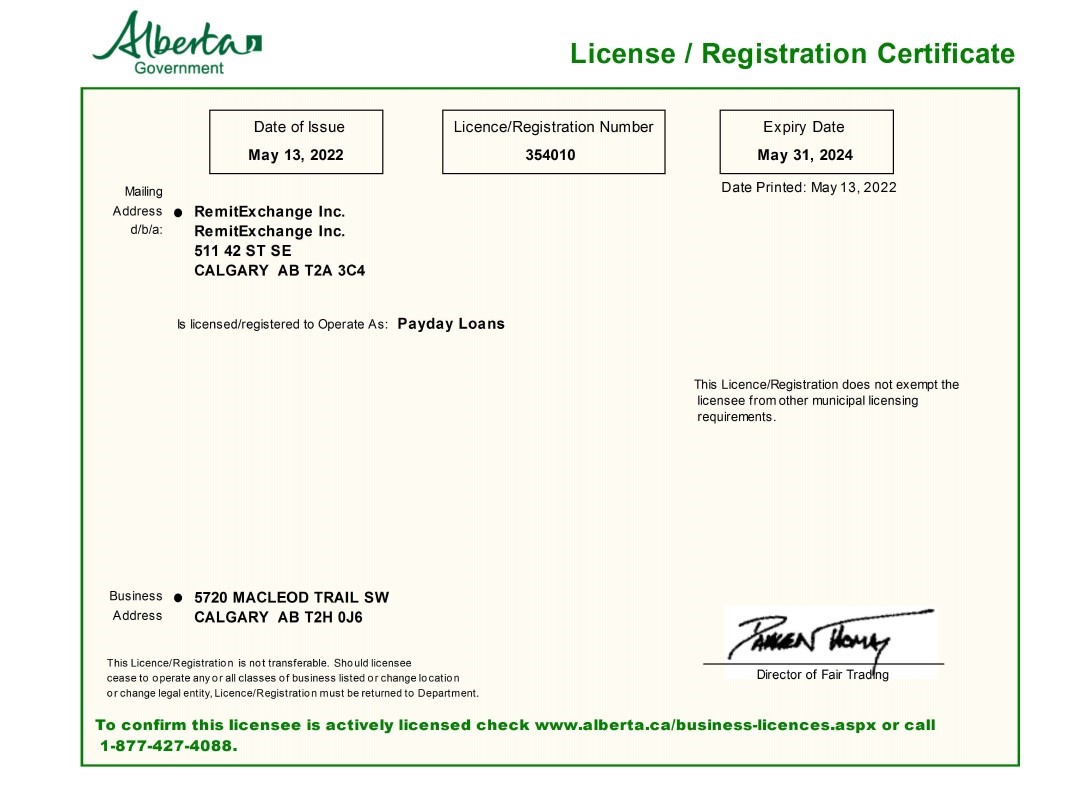

2.0 RemitExchange Inc License/Registration Number - 354010

3.0 Payday loans are a form of high-cost credit.

4.0 Fees and Charges:

If you obtain a payday loan from us, you will pay the following fees and charges:

• Loan Fee of 15% of the loan principal, payable on the loan repayment date.

• A charge of $25, for a dishonoured cheque or pre-authorized debit. This charge is payable only once per loan, regardless of the number of cheques or pre-authorized debits dishonoured.

• Default Interest of 30% per annum will be charged on the outstanding principal balance of the loan if you fail to pay the loan in full on the loan repayment date.

5.0 Customer Rights Under the Consumer Protection Act

As a payday loan customer in Alberta, you have the following protections under the Consumer Protection Act:

a. You have a two-day “cooling off” period. A payday loan customer has a two-day “cooling-off” period after signing a payday loan agreement.

This means that, during this two-day period (two business days), you can cancel your loan and return the money you borrowed with no extra fees.

If for some reason the payday loan company is not open for business on the second day, you have until the next business day to cancel the loan.

a. cancellation fee cannot be charged during the “cooling-off” period.

b. You can repay the full amount of the loan at any time. If a customer chooses to repay the full amount, the payday loan company cannot charge penalty fees for doing so. The payday lender may not charge you any penalty fees for repaying your loan before it is due.

c. When you agree to take out a payday loan, the payday loan company must provide you with a cancellation notice form. If you choose to cancel your loan, the completed cancellation form must be returned to the payday loan company along with the money during the two-day “cooling-off” period.

You can also cancel a loan by writing a letter to the payday loan company saying you want to cancel the agreement. You must deliver the signed letter and the money to the payday loan company during the two-day “cooling-off” period.

d. When a payday loan company gets your notice of cancellation, they must give you a receipt. When the payday loan company gives you a receipt, it means they accept the cancellation of your agreement.

6.0 Debt Counselling:

If you feel you may benefit from confidential debt counselling, Credit Counselling Canada can be reached by calling toll-free at 1-866-398-5999; by fax at 416-929-5256; by e-mail at contact@CreditCounsellingCanada.ca; or by mail at 401 Bay Street., Suite 1600, Toronto ON M5H 2Y4. You can also visit their website for further information at www.creditcounsellingcanada.ca.